Master Cash Flow Management for Small Business

If you're running a small business, mastering cash flow management is the single most important thing you can do for its survival and growth. At its core, it's about the simple, real-time pulse of money moving in and out of your business. It means you can pay your bills, your staff, and your suppliers on time, every time, without stress.

Cash flow is the lifeblood that keeps the lights on and your operations running, day in and day out. This guide provides easy-to-follow instructions and actionable insights you can implement today.

Why Cash Flow Is Your Business's Lifeblood

Think of cash flow as the heartbeat of your business. It’s the steady rhythm of money coming in from customers and then flowing back out to cover essentials like rent, payroll, and inventory. A strong, consistent heartbeat means your business is healthy and thriving. A weak or erratic one is a sign of serious trouble.

A common trap for entrepreneurs is confusing profit with having cash in the bank. You might look at your sales reports, see you're "profitable" on paper, and assume everything's fine. This is a massive misunderstanding that can be fatal for a business.

The Water Tank Analogy

Imagine your business is a giant water tank. The water inside is your available cash. Every time a customer pays you, it's like rain pouring in (cash inflow). Every time you pay a bill, it's like opening a tap at the bottom (cash outflow).

Profit is like knowing there’s a huge rainstorm coming next month. That’s great news, but it does nothing for you if your tank is empty today and you need water now. You can be "profitable" because you've invoiced a client for a big project, but if they haven't paid you yet, your tank is still dry. This is exactly how a profitable business can go under—it simply runs out of cash.

The harsh reality is that a staggering 82% of small businesses that fail do so because of poor cash flow management. They might be profitable, but they run out of the actual money needed for daily operations. To truly get a grip on your financial health and make sure your business thrives, you need to master small business cash flow management.

The Three Core Types of Cash Flow

To keep your "water tank" at a healthy level, you need to understand the different streams flowing in and out. Cash flow isn't just one big number; it's broken down into three key categories.

- Operating Activities: This is the money from your main, day-to-day business. For a coffee shop, it’s cash from selling lattes minus the cost of beans, milk, and payroll. This is your core operation. Actionable Step: Regularly review your operating cash flow to ensure your primary business model is healthy.

- Investing Activities: This is cash used to buy long-term assets to help you grow, like a new computer, a delivery van, or office furniture. Actionable Step: Plan for these large purchases so they don't unexpectedly drain your operating cash.

- Financing Activities: This is cash from outside sources. It’s money you get from a business loan or what you pay back on that loan each month. Actionable Step: Understand how loan payments will impact your cash flow before taking on debt.

Getting clear on these three flows is the first real step toward taking control. The numbers don't lie: in the US, while 91% of small firms find initial success, most don't make it past the five-year mark, largely due to these cash flow hurdles.

How to Create Your First Cash Flow Forecast

Let's move from just understanding cash flow to actually managing it. To do that, you need one essential tool: a forecast.

A cash flow forecast is your financial roadmap, showing you how much cash you can expect to move in and out of your business over the next few months. It's your early warning system, helping you spot potential shortfalls before they become emergencies. Think of it as a weather forecast for your finances. It’s not 100% accurate, but it gives you a clear enough picture to decide if you need to prepare for a storm.

Gathering Your Essential Documents

Before you can build your forecast, you need to pull together some basic information. This isn't complex accounting; it’s about collecting the pieces that show where your money is and where it's going.

Actionable Checklist: Grab these items:

- Recent Bank Statements: This shows your starting cash balance and past cash movements.

- Sales Projections: Your best, most realistic guess at future sales. To make your forecast solid, it's crucial to understand how to forecast sales and leverage data for growth.

- Accounts Receivable Report: A list of all unpaid customer invoices. This tells you what cash you can realistically expect to collect soon.

- Accounts Payable Report: A list of all your outstanding bills, showing what cash is scheduled to go out.

- Loan Statements: Details of your monthly loan or debt repayments.

With these documents, you have everything you need to start mapping out your financial future.

Choosing Your Forecasting Method

There are two main ways to build a cash flow forecast. While accountants use a complex "indirect method," the direct method is far more practical and intuitive for small business owners.

The direct method is exactly what it sounds like. You simply list all your expected cash inflows (money coming in) and all your expected cash outflows (money going out). It gives you a clear, real-world picture of your cash position, making it the perfect tool for hands-on management.

The goal isn't just to predict the future, but to prepare for it. The direct method gives you the clearest, most actionable view of your cash position, empowering you to make proactive decisions instead of reactive ones.

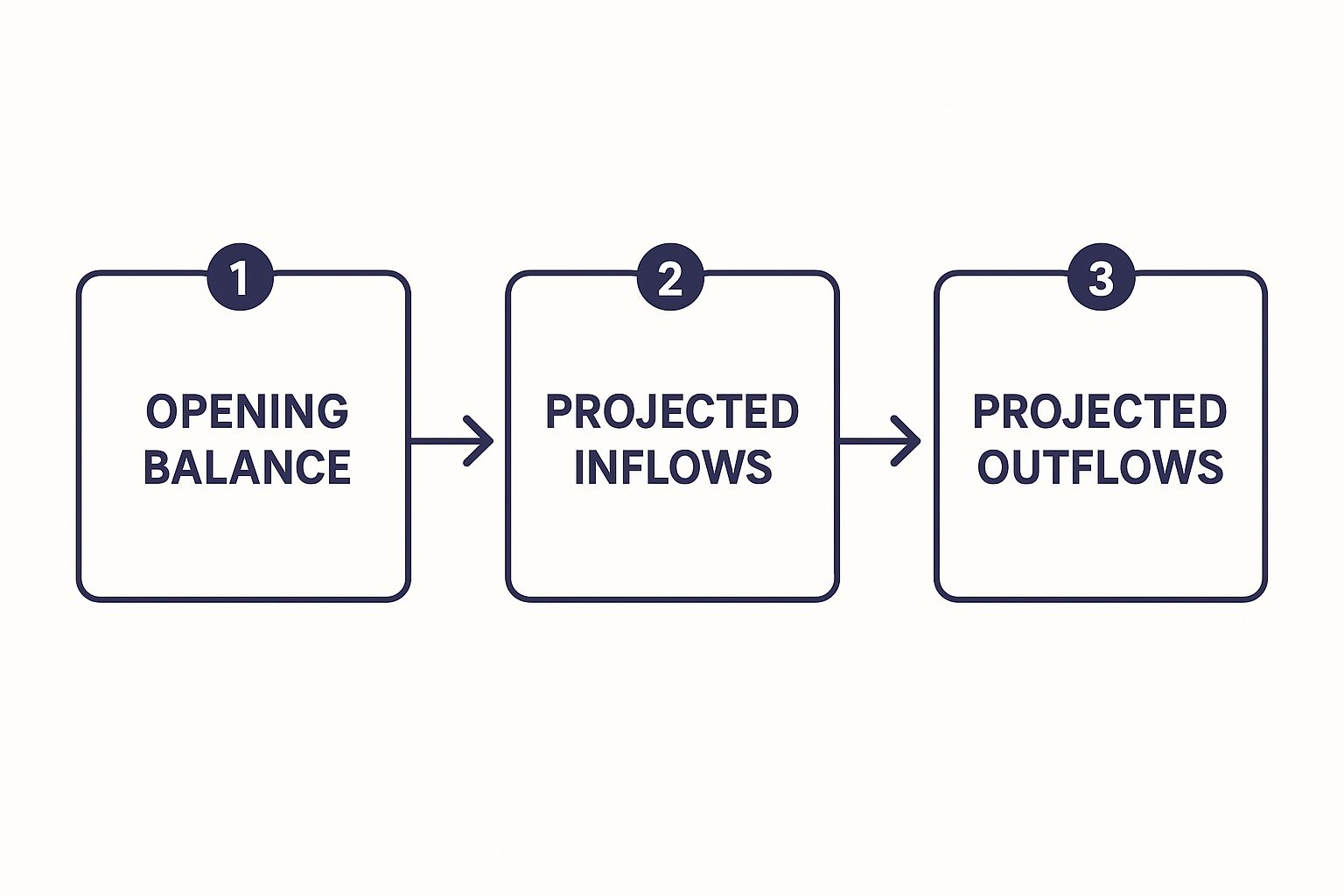

This infographic breaks down the simple, three-step logic behind the direct method.

It’s a straightforward process: you start with your current cash, add what you expect to receive, and subtract what you have to pay. Simple as that.

A Simple Walkthrough for a Retail Store

Let’s make this real. Imagine you own a small retail boutique and want to create a monthly forecast to stay ahead of any cash crunches.

Step 1: Determine Your Opening Balance

First, check your business bank account. Let's say you start Month 1 with $5,000. That’s your opening cash balance.

Step 2: Project Your Cash Inflows

Next, list all the cash you realistically expect to receive this month.

- Projected Sales: Based on last year's numbers and an upcoming promotion, you anticipate $10,000 in sales.

- Collected Receivables: You're owed $1,500 from a corporate client who has confirmed payment for this month.

- Total Projected Inflow: $10,000 + $1,500 = $11,500

Step 3: Project Your Cash Outflows

Now, list everything you plan to spend money on.

- Inventory: New stock for the season will cost $4,000.

- Rent: Your monthly shop rent is $2,000.

- Payroll: Staff wages for the month will be $3,500.

- Utilities & Other Bills: This covers electricity, internet, and software, totaling about $500.

- Total Projected Outflow: $4,000 + $2,000 + $3,500 + $500 = $10,000

Step 4: Calculate Your Closing Balance

Finally, do the simple math to see where you'll end the month.

- Opening Balance: $5,000

- Add Inflows: + $11,500

- Subtract Outflows: – $10,000

- Closing Balance: $6,500

That closing balance of $6,500 becomes the opening balance for Month 2. By repeating this simple exercise, the boutique owner can see she’s on solid ground for the month and can plan ahead with confidence.

Simple Cash Flow Forecasting Template (Direct Method)

| Category | Projected Month 1 | Projected Month 2 | Projected Month 3 |

|---|---|---|---|

| Opening Cash Balance | |||

| Cash Inflows | |||

| Sales Revenue | |||

| Receivables Collected | |||

| Other Income | |||

| Total Cash Inflows | |||

| Cash Outflows | |||

| Rent/Mortgage | |||

| Payroll | |||

| Inventory/Supplies | |||

| Utilities | |||

| Marketing | |||

| Loan Payments | |||

| Total Cash Outflows | |||

| Net Cash Flow | |||

| Closing Cash Balance |

This simple table is all you need to get started. Just fill in the blanks with your own numbers, and you'll have a powerful tool to keep your business financially healthy.

Proven Strategies to Boost Your Cash Inflow

A forecast shows you where you're headed, but you still have to steer the ship. The next step is actively improving your cash position by focusing on one goal: getting money into your bank account faster.

Let's walk through some proven, easy-to-implement strategies. Think of each tactic as a mini-playbook you can put into action today. A few small tweaks can turn a stressful cash crunch into a steady, reliable flow.

Overhaul Your Invoicing Process

Your invoice is the starting gun for getting paid. A confusing, inaccurate, or delayed invoice is one of the biggest roadblocks to quick payment. Stop treating invoicing as a chore and start seeing it as a key part of your sales cycle.

Actionable Insights:

- Invoice Immediately: Instead of batching invoices at the end of the month, send them right after a service is completed or a product is delivered. This closes the gap between the customer receiving value and paying for it.

- Offer Early Payment Discounts: A classic win-win. Offer a small discount, like 2%, if an invoice is paid within 10 days instead of 30. You get cash faster, and your client saves money.

- Automate Reminders: Use accounting software to send polite payment reminders automatically. This ensures follow-ups happen on schedule without you having to play debt collector.

- Enforce Late Fees: Clearly state on your invoice that a late fee will be applied after the due date. This sets a professional boundary and gives clients a clear incentive to pay on time.

Make It Stupidly Easy for Customers to Pay You

The more hoops a customer has to jump through to pay you, the longer it will take. If they have to find a checkbook, you’ve created friction that invites procrastination. A simple "Pay Now" button is effortless.

Think about your own buying habits. You’re more likely to complete a purchase if your preferred payment method is available with one click. Apply that same friction-free logic to your business.

By diversifying your payment options, you cater to modern customer habits. Research shows that businesses offering multiple payment methods can improve their collection times significantly, as it removes the "I'll do it later" excuse.

Actionable Step: Ensure you are set up to accept every common payment type:

- Credit and Debit Cards: An absolute must-have.

- Online Payment Platforms: Use trusted services like PayPal, Stripe, or Square.

- ACH (Bank) Transfers: A great low-fee option for larger B2B transactions.

- Mobile Wallets: Options like Apple Pay or Google Pay are fast and secure.

Implement Proactive Cash-Generating Tactics

Getting paid for work you've already done is one thing, but what if you could bring cash in earlier and more predictably? This is about shifting from a reactive collections mindset to a proactive revenue strategy.

Actionable Insights:

- Require Deposits: For large projects or custom orders, always require a deposit upfront. This immediately improves your cash position before you've spent a dime on the work.

- Create Recurring Revenue: A subscription or membership model provides predictable income you can count on every month. This smooths out the peaks and valleys in your cash flow and makes forecasting easier. For more ideas, check out our guide on boosting your beauty salon profit margins.

Smart Ways to Control Your Cash Outflow

Bringing more cash in is only half the battle. To get a real handle on your finances, you have to be just as strategic about the money going out.

Controlling outflow isn't about pinching pennies so hard you stunt your growth. It's about making smart, deliberate spending decisions to build a rock-solid financial foundation. Think of it like plugging leaks in a bucket. You can keep pouring water in (revenue), but if you don't plug the holes (expenses), you'll constantly struggle.

Conduct a Regular Expense Audit

First, you need to know exactly where your money is going. An expense audit is a simple but powerful exercise where you review every single business expense from the last few months.

Actionable Step: Go through your bank and credit card statements, line by line. As you review each expense, sort it into one of three buckets:

- Essential: Things you can't operate without (e.g., rent, core software).

- Nice-to-Have: Things that help but aren't critical (e.g., premium software subscriptions).

- Non-Essential: Things you can cut without impacting the business (e.g., unused subscriptions).

Your goal isn't just to see where money went, but to question why it went there. Ask yourself for each expense: "Does this directly contribute to my revenue, or is it just a habit?" This mindset shifts you from a passive spender to an active financial manager.

You'd be shocked at how many businesses pay for redundant services they forgot they had. This simple task brings instant clarity and almost always highlights quick ways to save.

Renegotiate Terms with Your Suppliers

Your relationship with your suppliers is a two-way street, and there’s often wiggle room in payment terms. One of the most effective ways to improve cash flow is to extend your payment cycles, giving you more time to use your cash before it has to leave your account.

Actionable Step: If you typically pay suppliers in 30 days (Net 30), open a conversation about moving to Net 45 or Net 60. Frame it as a way to strengthen your long-term partnership.

Here’s a simple script you can adapt:

- Acknowledge the partnership: "We've really valued our partnership over the past two years."

- Explain your goal: "As we work on aligning our cash flow for better planning, we're standardizing our payment terms with key partners."

- Make the ask: "Would it be possible to adjust our terms to Net 60 moving forward? This would greatly help us manage our seasonal cycles."

A supplier who values your business will often be willing to accommodate, especially if you have a strong history of paying on time.

Be Smart About Major Purchases

Big, upfront purchases can drain your cash reserves in an instant. Before making a major capital expenditure—like new equipment or a company vehicle—stop and carefully consider the alternatives.

Actionable Insights:

- Consider Leasing: Leasing is a fantastic strategy for preserving cash. Instead of a $20,000 upfront cost for a new machine, you might pay a few hundred dollars a month. This keeps your cash available for daily operations.

- Control Your Inventory: Excess stock is cash sitting on a shelf. It ties up funds that could be used for marketing, payroll, or paying down debt. Use a smart inventory system to ensure you have enough to meet demand without overstocking and strangling your cash flow. If you run a salon, check out our guide on finding the right salon inventory management system.

By making smarter, more deliberate choices about your outflows, you build a more resilient and financially secure business.

Using Technology to Simplify Cash Flow Management

Manually tracking every dollar is a fast track to burnout and costly mistakes. Thankfully, you don't need to spend nights hunched over a spreadsheet. The right tech can act as your always-on financial assistant, automating tedious tasks and giving you a clear, real-time picture of your financial health.

Choosing Your Core Financial Software

For most small businesses, good accounting software is the foundation of a solid tech setup. Platforms like QuickBooks and Xero were built for owners like you, turning complex bookkeeping into something manageable. They pull all your financial data into one clean, easy-to-read dashboard.

Key Features for Cash Flow:

- Real-Time Dashboards: Get a live, at-a-glance view of your cash on hand, who owes you money, and what bills are coming up.

- Bank Reconciliation: Connect your business bank accounts to automatically import and categorize transactions, so you know exactly where your money is going.

- Expense Tracking: Snap a picture of a receipt with your phone, and the software logs the expense for you.

Automating Invoicing and Collections

Slow invoicing is a major cash flow killer. Automated invoicing platforms completely flip the script.

Actionable Step: Use your accounting software to instantly generate and send an invoice the second a job is done. Set up automated follow-up reminders to clients with overdue payments. This takes the awkwardness out of chasing money and dramatically speeds up how quickly you get paid.

Here’s a look at the clean, professional invoicing interface from Xero. It makes it dead simple to see what’s paid, what’s pending, and what's overdue.

That kind of visual clarity lets you spot problems immediately, so you can be proactive about getting cash in the door.

The shift to digital tools isn't just a trend; it's become standard practice for smart businesses. After the pandemic, owners raced to adopt financial dashboards and automated billing to sharpen their forecasting and get paid faster. In fact, studies show that 58.7% of businesses that adopted accounts payable technology saw fewer invoicing errors—a direct boost to healthier cash flow. You can learn more about these cash flow trends and how they’re shaping business today.

Gaining Control with Specialized Tools

Beyond your main accounting software, specialized apps can solve specific cash flow headaches. Think of it as building a custom toolkit for your business's unique needs.

Actionable Tools to Explore:

- Expense Management Apps: If you have employees, tools like Expensify or Dext make tracking receipts and reimbursements a breeze.

- Payment Processors: Platforms like Stripe or Square make it incredibly easy to accept online payments, so cash hits your account in days, not weeks.

- Forecasting Software: For businesses ready to level up, tools like Float or Jirav plug into your accounting software to create powerful, forward-looking cash flow projections.

By embracing these tools, you can move from constantly putting out financial fires to building a proactive strategy.

Common Cash flow Mistakes and How to Avoid Them

Running a small business is like spinning plates—it's easy to let one wobble and crash. When it comes to cash flow, a few common mistakes can bring the whole show to a halt. Think of this as your defensive playbook for avoiding unforced errors.

Mixing Personal and Business Finances

This is a financial death trap. Treating your business bank account like a personal piggy bank makes it impossible to know how your company is really doing. It turns tax season into a nightmare and can even put your personal assets at risk.

The Fix (Non-Negotiable):

- Get a dedicated business bank account. All business income goes in, all business expenses come out. No exceptions.

- Open a separate business credit card. Use it strictly for business purchases.

- Pay yourself a real salary. Set up a regular, consistent transfer from your business account to your personal one. Treat yourself like any other employee.

Making Large Investments Without a Plan

It’s easy to get swept up in the excitement of growth. But dropping a huge chunk of cash on a major purchase without a clear plan for how it will pay you back is a massive gamble. A big investment can drain your cash reserves, leaving you exposed if an unexpected bill pops up.

Before you sign any big checks, you absolutely have to calculate the investment's payback period. That’s just a fancy way of asking: "How long will it take for this thing to make enough money to cover its own cost?" If the answer is too long or a total guess, it’s a sign to hit the brakes, delay the purchase, or look into alternatives like leasing.

Ignoring Your Emergency Cash Reserve

Business is never a straight line. A key client pays late. A critical piece of equipment dies. Without a cash cushion, these everyday bumps in the road can turn into full-blown crises. Flying without an emergency fund is like sailing in a storm without a life raft.

Actionable Step: Build a cash reserve that can cover three to six months of essential operating expenses. You don't have to do it all at once. Start by automatically transferring a small percentage of your revenue into a separate savings account each month. This fund is your ultimate safety net, giving you the peace of mind and stability to ride out any storm.

Answering Your Top Cash Flow Questions

Even when you have a handle on things, questions are bound to pop up. Here are quick, no-nonsense answers to the most common queries.

How Often Should I Check My Cash Flow?

For day-to-day management, a quick weekly check is perfect. This doesn't need to take more than 15-30 minutes. Just review your bank balance, upcoming bills, and expected payments to spot potential issues early.

Once a month, do a more strategic review. This is when you compare your forecast to what actually happened and adjust your plan for the coming months. This simple routine keeps your strategy sharp and grounded in reality.

What Is a Good Cash Flow Margin?

While the "perfect" number varies by industry, a healthy operating cash flow margin for most small businesses is between 10-15%.

A 10% margin means that for every dollar in sales you bring in, you’re successfully turning 10 cents of it into cold, hard cash your business can actually use. Honestly, the most important thing isn't hitting some magic number. It's about consistently tracking this metric and always looking for ways to nudge it upward.

I See a Cash Shortage Coming. What Is My First Move?

If your forecast shows a cash crunch ahead, act immediately. Don't wait. Your first move is a swift, two-pronged attack to create breathing room.

- Speed Up Your "Cash In": Get on the phone with your largest overdue accounts. A personal call goes a long way in securing a firm payment commitment.

- Slow Down Your "Cash Out": Review your upcoming bills. Reach out to vendors for non-critical expenses and politely ask for a temporary payment extension. Most are willing to work with you if you're proactive.

This dual approach buys you precious time to find a more permanent solution and get back in the driver's seat.

Ready to create a stunning online presence that attracts clients and showcases your unique brand? gohappybeauty provides beautiful, SEO-optimized websites designed specifically for beauty professionals like you. Start building your dream website today at https://gohappybeauty.com.

Grow your beauty business

Our focus is, and always will be, helping you improve your online presence and generate more business from your website. That is what we do, for you.